The global manufacturing industry is reconsidering and repositioning its strategy due to the various changes in economic and political factors. Today, businesses are increasingly diversifying their sourcing and manufacturing strategies, among which Southeast Asia is quickly becoming a strategic cornerstone of modern supply chains. The diversification to Southeast Asia isn’t a novel solution, and has been practiced for a while, primarily due to its cost-effective solutions.

In the current scenario, various factors such as geopolitical pressures and tariffs are expected to cause supply chain fragility, which is why there is an imperative requirement to diversify risks. Among various strategic considerations, Southeast Asia has emerged as a preferred destination. In this article, we discuss why Southeast Asia is considered a manufacturing powerhouse for continuous growth.

Southeast Asia is a manufacturing powerhouse. Some of the major Southeast Asian manufacturing countries of this region are Thailand, Vietnam, Malaysia, Indonesia, Singapore, and the Philippines.

Let’s understand the major Southeast Asian manufacturing countries further in this section:

Vietnam’s strengths are its cost-competitive labor and increasing foreign direct investment. Vietnam is one of the most significant sectors in the manufacturing of electronics and semiconductors. It’s also a global export leader for textiles, garments, and furniture products.

Indonesia is experiencing substantial growth in the metals and chemicals industry. It’s resource-rich and has growing industrial zones. It’s a major exporter of textiles and apparel to the US and Japan. It’s also known as the ASEAN hub for Japanese car makers, as it is one of the major manufacturing hubs for the automotive industry.

Malaysia has an established tech base. In addition, it has strong infrastructure and skilled labor.

Malaysia is a major hub for electrical component manufacturing. International companies contribute to the steady growth of the semiconductor industry. It is also one of the major exporters for medical devices.

Thailand has strong supply chains, developed infrastructure, and government incentives.

Thailand is widely known as the Detroit of Asia or the Detroit of Southeast Asia, as it has the largest automotive manufacturing hub in the ASEAN area. Since it has a strong automotive sector, it is apt for companies seeking to diversify their manufacturing bases. It is also known for manufacturing electronics and medical devices, for which it is one of the top exporters in these sectors.

Singapore is an apt sourcing and manufacturing destination for manufacturers seeking cutting-edge capabilities and high-value manufacturing, i.e., advanced electronics, biotechnology, and precision engineering, making it a preferred destination. Its strengths are its research and development hubs and highly developed infrastructure.

The Philippines has a skilled English-speaking workforce. It’s a major manufacturer of garments and textiles. It also manufactures electronics and semiconductors that are particularly exported to the U.S. and Asia.

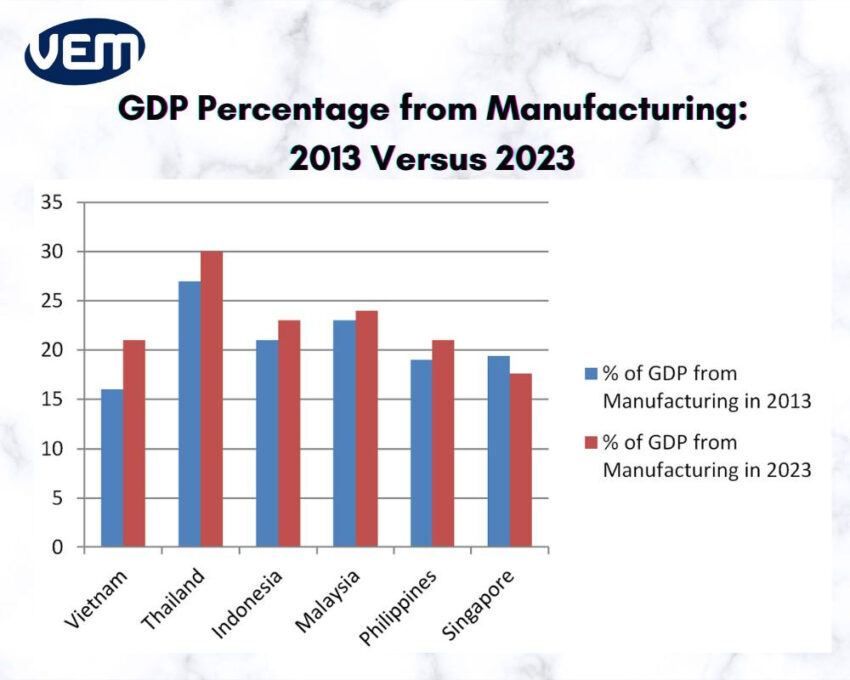

The following infographic depicts the manufacturing scenario in Southeast Asia. It represents the change in GDP due to manufacturing from 2013 to 2023 for the major ASEAN manufacturing hubs.

The above infographic indicates that Thailand stands out as an ASEAN manufacturing hub, followed by Malaysia, Indonesia, and Vietnam. It also indicates that the Philippines may be behind in volume but is steadily growing, whereas Singapore has experienced a decline.

This growth indicates that Southeast Asia is redefining global supply chains, and more and more companies are willing to diversify their manufacturing focus.

It was largely observed during the global pandemic that the diversification of the supply chain isn’t optional. Strategically, it’s proving to be extremely essential since most of the lean and efficient systems are vulnerable in changing environments.

A single manufacturing hub that is typically centered in one destination is subjected to various operational risks such as disruptions from lockdowns or natural disasters, rising labor costs, and political uncertainty.

Southeast Asia offers companies an option to diversify their operations. In addition, it enables companies to decentralize risk and balance costs. Companies are now adopting a China+1 or China+Many strategy, with Southeast Asian nations to diversify and fill the gaps.

Southeast Asia offers strategic insurance for companies that want to adopt and adapt to new and alternative supply chains. This region is a smart move for the present to ensure that your manufacturing operations continue to be efficient.

Over the past few months, changes in tariffs have led to trade tensions. The ongoing U.S.-China trade tensions have been a key catalyst. Since the tariffs on China are increasing unpredictably, companies are forced to re-strategize to novel solutions such as shifting parts of their supply chains to countries such as Vietnam, Thailand, and Malaysia. This not only enables businesses to deal with increased tariffs but also enables them to avoid the volatility altogether.

Southeast Asia enables businesses to mitigate risks associated with reliance on only a single market. You can read more about the Tariff Policies here.

Southeast Asia has emerged as a key player in global supply chain management. In recent years, the region’s affordability and availability of skilled workforce, along with its proximity to major global markets and infrastructure development, have encouraged many international businesses to consider repositioning their manufacturing centers in Southeast Asian nations.

Today, manufacturing in Southeast Asia is not just an alternative to China but is also shaping up to be one of the pillars for the future manufacturing industry. As there are various global economic realignments underway, Southeast Asia is positioned to provide diversification and long-term strategic value.

Southeast Asia’s geographic location is extremely strategic, as it’s situated between major global markets and provides a natural logistical center for exports to North America and European countries; thus, it’s ideal for companies’ supply chain activities. Southeast Asia is also proximal to major markets of various countries, i.e., China, India, Australia, and the Middle East, thus, it offers significant logistical advantages to businesses as it enables them to reach a diverse consumer base efficiently.

Southeast Asia’s location grants access to some of the most pivotal shipping lanes and important ports. Such accesses facilitate seamless connectivity with international markets, thereby enabling efficient and easy movement across borders. In addition, the well-developed transportation infrastructure within Southeast Asia enhances its connectivity and accessibility to global markets. Thus, manufacturing hubs operating in Southeast Asia demonstrate greater flexibility in the frequently changing market.

Southeast Asian nations generally have well-balanced diplomatic relations with major nations on a global scale. Comparatively, this type of geopolitical neutrality creates an insulation from the changing political scenarios and trade wars.

Southeast Asian nations such as Vietnam and Thailand have an extremely skilled labor and workforce. In addition, countries such as Thailand and Singapore have technical talent and expertise in engineering.

Southeast Asia has lower manufacturing operating costs, which is why companies can enhance their profit margins. Comparatively, the labor expenses in Vietnam and Thailand are 50-60% lower.

The manufacturing costs are lower, and the workforce is skilled. These aspects are enriched by the fact that production capabilities are also continually maturing in Vietnam and Thailand. There is a growing expertise in specialized manufacturing skills of various industries such as electronics, medical devices, automotives, and textiles.

The infrastructure of Southeast Asia has significantly improved in the recent decade, such that it has striven to make notable advancements. For instance, Port facilities such as Laem Chabang in Thailand and Tan Cang-Cat Lai in Vietnam have upgraded to improve their efficiency and enhance their capacity substantially. There have also been various rail and road-related connectivity projects that have strengthened the transportation networks within and to Southeast Asia. These infrastructure enhancements have significantly reduced logistical bottlenecks.

In addition, Southeast Asia has also developed to include an increased number of industrial parks, which are well-equipped with ready-to-use facilities.

Governments across Southeast Asia are actively investing in infrastructure and industrial zones, thus enabling the region to become an attractive destination for manufacturing and supply chain activities. For instance, Thailand’s Eastern Economic Corridor (EEC)

Governments of Southeast Asian countries are very proactive in creating trade agreements and partnerships to create opportunities for businesses. The implementation of various policies and initiatives also helps to drive business growth and attract foreign investment.

The governments of Southeast Asia are not only focused on infrastructure development but also on regulatory reforms that are aimed at streamlining trade procedures and removing bureaucratic hurdles to improve efficiency for businesses.

Despite the strategic benefits to manufacturing and sourcing in Southeast Asia, there are certain challenges that the companies must note and approach with a long-term vision. view. Let’s understand these challenges further:

You should note that these challenges are not static, and the governments are actively involved in standardizing labor laws and investing in vocational education to further reduce cultural and language barriers.

Thailand’s manufacturing ecosystem has attracted global manufacturers due to its cutting-edge infrastructure and an expansive network of industrial parks that make manufacturing operations efficient and scalable.

Thailand has established itself as one of the top manufacturing countries in the ASEAN manufacturing hub. If you are seeking to manufacture or expand your operations in Asia, Thailand is strategically apt. It’s recognized for its modern infrastructure, well-established logistical networks, skilled labor force, strong IP laws, regional free trade agreements, and strategic geographical location. These aspects make Thailand a go-to hub for companies seeking an efficient, export-ready, and scalable manufacturing base in Southeast Asia.

Thailand’s infrastructure is purpose-built to facilitate an efficient manufacturing ecosystem. Let’s understand some of the key features of Thailand’s infrastructure:

Thailand’s industrial ecosystems encompass 60+ industrial parks and are engineered for excellence. The industrial parks enable the companies to launch operations quickly and efficiently as the infrastructure, utilities, warehousing, and residential areas are pre-built.

Thailand also offers EEC, abbreviated for Eastern Economic Corridor, which is a development plan for manufacturing upgrade. It’s anchored by Laem Chabang Port and U-Tapao Airport and is a high-tech corridor. EEC offers foreign investors incentives such as tax holidays, land ownership rights, and fast-track visas. You can read more about EEC here.

Southeast Asia is transforming into a global supply chain destination due to its cost-competitiveness, developed infrastructure, and skilled workforce. VEM Tooling has over 20 years of experience in supply chain management and manufacturing high-quality parts within Southeast Asia. If you are looking to explore a new supply chain destination or optimize your existing operations, we can guide you to navigate the Southeast Asian region and provide you with the expertise and insights.